Stockpile Cash or Invest in Real Estate?

Let's Dive Right In...

To answer this question, let’s take a look at the capital market and the rental / housing market.

Rental demand is remaining strong; most vacancies are less than 30 days for our market. Rental price increases continue to charge upward as well with an average increase of 8-10% on a unit turn and 5-8% on a renewal. We have seen many larger increases on units we have assummed from either other management companies or former self managed properties.

We are continuing to see people relocating to our area for jobs and wanting to rent vs buy.

Housing Prices and Rates

Not so long ago, if you were in the market to buy or sell, you know it was a very competitive sellers’ market with multiple offers and commonly homes sold over list price. Rising rates have put pressure on housing prices due to affordability. The result is less buyers are at the table and slightly softer sale prices. This of course is not necessarily a bad thing. The housing market was accelerating very rapidly. This was a natural reaction due to the combination of affordability and weak supply. Now, homes aren’t as affordable, however the supply situation is not resolved. Nationally, we are still roughly 3.8 to 5 million units short on housing. To further add fuel to the shortage, builders have taken a cautionary step back after they felt the impact of their debt service load when rates came up.

Simplified, we have these two forces working against each other as yin and yang to find the balance point of housing prices. Rates are forcing down, while Supply Shortages are applying upward pressure.

We’ll talk more about how this plays into whether we should buy or stockpile in a minute, but first let’s take a look at what cash is doing.

Cash and the Cost of “Keeping it Safe”

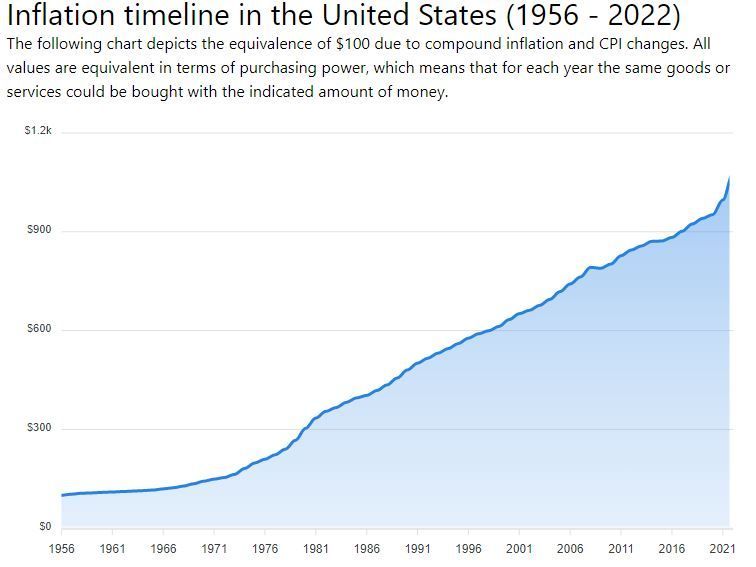

When trouble hits the economy one of our first reactions might be to sideline the noise and get out of the action. Not always a bad play, at least for brief periods while getting a better grip on the direction of things. The trouble with holding that hand too long, is we have a fiat currency. Fiat currencies have a much higher chance to experience inflationary pressures than not. In other words, someone can always be counted on to print or digitize more, thus decreasing the buying power of the ones we hold. In lower inflationary times, it’s difficult to notice the decreased buying power of the dollar. The chart below (Inflationtool.com) shows the inflationary period of CPI (the government measure of inflation) from 1956-2021. Economists argue whether CPI, through its various definition changes, even measures the true cost of inflation. Regardless, it still serves to demonstrate the general trend. Take a look at the 70s when we detached from the gold standard. Then, look again at how steep the curve goes almost straight up in 2021 as the impact of pandemic money printing and supply disruptions take hold.

Every time the bar rises, our purchasing power for dollars earned falls. If our money is sitting in a bank making less than the “Real” cost of inflation, not the CPI, we are literally losing wealth.

To figure the actual cost we would have to know the real inflation rate, which you can google to find estimates for. For this article, we will stick with CPI numbers and know that the real cost down the road is probably higher than CPI.

Stockpile or Invest

You might be thinking at this point, so Cash is losing Real Purchasing Power, Loosing Value, but housing prices have softened too. Yes, that’s all true.

In buy and hold REI, of course we care about the asset value, but our more important metric is the profitability over the term of the hold. The same question could be applied to cash.

If I hold Cash for the next 3 years, vs holding a REI for the next 3, where will I be? For 5,10 and so on and so forth.

Cash Flowing Rentals are adjusting with the market. Rents have been keeping pace or exceeding inflation in our area. Cash has been losing value.

Summing It Up!

Long term Housing Values Don’t Fall. Long term Fiat Cash Value Does!

Idle Capital is wealth eroding in this economic time. Cash Flowing REIs are a way to put your Capital to work, protect it from inflationary pressure, and potentially make both short and long term profit.

Steps to Take, Steps to Avoid to "Really" Play it Safe!

- Work with a Realtor that specializes in Investment Property

- Identify Selective Cash Flowing Properties with Low Cost Inputs

- Fixed Interest Rates can hedge inflation and Provide stability to investments

- Go with a Professional PM and choose wisely – Poorly or Under Managed Properties will not be profitable and seem like a mistake.

- For Existing Properties or planning purposes for newly purchased property; Adjust Cash Reserves for property expenses to keep pace with inflationary cash value leaks.

- Avoid Speculative Purchasing.

- Avoid Properties with Major improvements needed unless you have a firm grip on true cost for needed improvements. Many construction related cost have recently risen.

- Cash Heavy Investors can capitalize on softer prices and improve returns with more money down to reduce their financing expenses.

Everyone has unique circumstances. Different properties and property types as well as investment strategies will differ to fit individual needs. Working with an experienced Investment agent and PM is a great place to start to analyze your situation and goals.

I'd love to hear from you and your thoughts on this article. If you have questions about the current Real Estate Market, Investments, or the effects of inflation in Lee's Summit, Blue Springs, Raymore, Lone Jack, Pleasant Hill, Grain Valley, Independence, Overland Park, KS or surrounding areas. Click below to give us a call or send us a message by text in lower right!

Share this post